seattle payroll tax reddit

Council Set to Pass JumpStart Seattle Payroll Tax. 17 votes 25 comments.

Why Some Plan To Opt Out Of New Wa Long Term Care Insurance R Seattle

Full Council vote Monday.

. Seattle mayor slams proposed payroll tax thats promising to provide stimulus checks. For 2022 the tax imposes tiered rates based on the companys total annual payroll and is imposed on companies with at least 738 million in 2021 annual Seattle. The law specifically precludes employers from withholding the tax from their employees.

It is levied on businesses with an annual payroll of 7 million per year or. Press J to jump to the feed. 17 of annual salaries exceeding 400000.

If you move out of state you wont get the benefit and if you are low income you will already be covered by. Seattle payroll tax reddit Tuesday February 22 2022 Edit Heres what your gaming rig needs to let you soar above the clouds. Subreddit for payroll and HRIS professionals.

Payroll Expense and Annual Comp updated for 2022 CPI Adjustment Less than 105521339 105521339 but less than 1055213392 1055213392 or greater Annual compensation. Dubbed JumpStart Seattle the legislation passed budget. Payroll Expense Tax Effective Jan.

1 2021 SMC 538 imposes a payroll expense tax on persons engaging in business within Seattle. Press question mark to learn the rest of the keyboard shortcuts. The payroll expense tax is levied upon businesses not individual employees.

Log In Sign Up. The spending plan provides the most detail to-date on how Seattles new payroll tax will be used. Press J to jump to the feed.

Council commitee passes JumpStart Seattle tax on companies payrolls per employees making over 150K. The Best Employee Scheduling Shift Planning Software. News current events in around Seattle Washington USA.

For those not aware Washington is implementing a new 58 payroll tax unless you get a qualifying LTC insurance and opt out in October. Full Council vote Monday. 450k members in the Seattle community.

O Rates are based on payroll expense in Seattle in current year. Because the tax is on incomes over 150K and Amazon hires a lot of people that make less than 150K. Payroll Expense Tax Effective Jan.

255k members in the SeattleWA community. As Seattle payroll tax looms Bellevue brokers says companies look east. The payroll expense tax is a tax on employers that have Seattle annual payroll expense of 7386494 or more.

Press J to jump to the feed. Column D Taxable Amount. It is not imposed on the.

The payroll expense tax is levied upon businesses not individual employees. Business leaders expressed concern when lawmakers approved a new payroll tax in 2020 on Seattles largest companies part of a longstanding effort to increase funding for affordable housing and. WwwFileLocal-wagov Column A Column B Column C Column D Column E Column F 400000 or more x 0024.

The payroll expense tax is a tax on employers that have Seattle annual payroll expense of 7 million or more. The tax is levied on businesses and nonprofits with more than 7 million in Seattle employee payroll in the 2020 calendar year. Council commitee passes JumpStart Seattle tax on companies payrolls per employees making over 150K.

Protesters react as Nikkita Oliver takes the stage at City Hall on Wednesday June 3rd. Amazon is going to keep its recruiting and operations orgs in Seattle and move engineering and execs over east side. Log In Sign Up.

OThe tax is imposed on the business. 18 Microsoft Flight Simulator goes airborne on PC. Payroll expense tax will be reported and paid on a quarterly basis.

Full details about rates can be found on page 9 of the Department of Finance. RSeattleWA is the active Reddit community for Seattle Washington and the Puget. 1 2021 Council Bill 119810 SMC 538 imposes a payroll expense tax on persons engaging in business within Seattle.

Employers with annual payroll expenses of more than 1 billion per year will be taxed. OThe tax is on businesses with 7 million or higher Seattle payroll expense in prior year. The seattle payroll tax is measured by the payroll expense of the business times a rate that varies based on the businesss total seattle payroll expenses and.

The tax is paid by the. The legislation only applies to the. Subreddit for payroll and HRIS professionals.

SeattleWA 35 votes 27 comments. Press question mark to learn the rest of the keyboard shortcuts Search within rSeattleWA. Photo by author The Seattle City Council is poised to pass a payroll expense tax package to fund Covid-19 relief and affordable housing at its 2pm meeting today.

Tax Rates Tax is on payroll expense of employees with 158282 or more in annual compensation. 14 of annual. 206 684-8484 Fax.

CITY OF SEATTLE - PAYROLL EXPENSE TAX RETURN To file this form electronically please go to. Companies with annual payroll exceeding 1 billion would pay a 14 tax on salaries between 150000-499999 and a 21 tax on salaries greater than 500000. 07 of annual salaries between 150000-399999.

Seattle S New Payroll Tax Is A Gamble Seattle Met We also provide tools to help businesses grow network and hire. You only have this one moment to opt-out or you will be taxed an additional 58 for the rest of your working years in Washington. The tax burden for one exec making 1 million a year is the same as 17000 employees who make 200K.

RSeattleWA is the active Reddit community for Seattle Washington and the Puget. The tax is paid by the employer and there is no individual withholding. Is this a tax on the employee.

This illegal tax puts seattles economic recovery at. Search all of Reddit. The tax applies to salaries more than 150000 annually at graduated rates depending on both an individuals salary and the employers total Seattle payroll.

Mail the original copy with your payment to. It is not imposed on the employee and is not a withholding from employees compensation. OThe tax is imposed on the business.

OThe tax is on businesses with 7 million or more Seattle payroll expense in prior year. 14 votes 50 comments. 13k members in the Payroll community.

Press question mark to learn the rest of the keyboard shortcuts. 198k members in the SeattleWA community. The Seattle payroll tax colloquially known as the JumpStart Seattle tax collected more than 231 million for 2021 exceeding the citys early estimates by more than 15 percent.

The legislation passed earlier this month establishes a.

Any Thoughts On This New Long Term Care Tax R Seattle

Council Uses Jumpstart Payroll Tax To Fuel Big Affordable Housing Investments In 2022 Budget Slog The Stranger

Seattle Business Leaders Ask City To Reconsider Tax After Amazon Polls Employees About Relocation Geekwire

It Would Be A Travesty To Cave To Business Leaders Who Want To Preempt New Seattle Taxes The Urbanist

Seattle S New Payroll Tax Is A Gamble Seattle Met

Seattle City Council Unveils New Payroll Tax Targeting Amazon And Other Large Companies Geekwire

What Happened To Washington S Long Term Care Tax Seattle Met

Seattle Metropolitan Chamber Of Commerce Sues City Over Illegal Payroll Tax On Big Businesses Seattle Seattle Digital News Payroll Taxes

Wa Cares Ltc Tax Officially Delayed Until July 2023 R Seattle

These 4 Fortune 100 Companies Paid Negative Taxes In 2021

Tax The Rich R Whitepeopletwitter

Seattle Keeps Growing Despite The Dying Pronouncements The Urbanist

Seattle S Coronavirus Timeline From Toilet Paper To Mask Laws Seattle Met

Damn Okay Seattle City Council Has A Lot Of Progressive Revenue Options Now Slog The Stranger

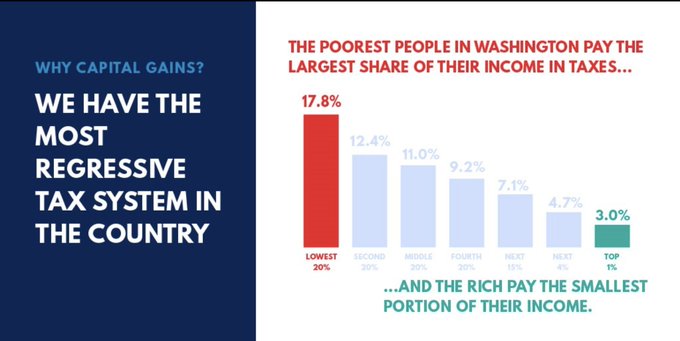

Washington State Has The Most Regressive Tax Structure In The United States R Seattle

Bingo Amazon Is Getting Taxed Slog The Stranger

Governor Inslee Extends Rent Freeze And Eviction Moratorium Queues Up Payroll Tax Debate The Urbanist

How To Opt Out Of Coming Payroll Tax Payroll Taxes Insurance Fund Payroll

Seattle S Big Business Tax 1 Year Later Controversial Policy Generates Unexpected Surplus Geekwire